Will BTC Hit $150K+ After the 2024 Halving?

Bitcoin’s halving events have historically been major catalysts for price surges. The 2024 halving reduced miner rewards from 6.25 BTC to 3.125 BTC per block, further tightening supply. As we move into 2025, analysts are debating whether Bitcoin could surpass $150,000—or even reach new all-time highs.

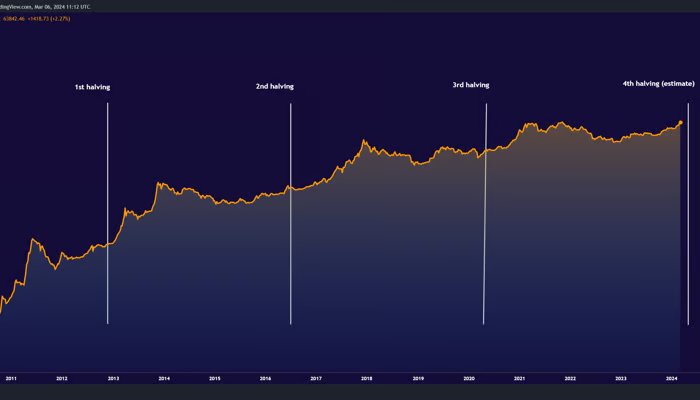

Historical Halving Impact on BTC Price

- 2012 Halving: BTC surged from ~$12 to over $1,100 in a year.

- 2016 Halving: Price climbed from ~$650 to nearly $20,000 by late 2017.

- 2020 Halving: BTC rose from ~$9,000 to an ATH of $69,000 in November 2021.

If history repeats itself, Bitcoin could experience a 6x-10x increase from its pre-halving price, potentially pushing it beyond $150K in 2025.

Institutional Adoption: A Key Driver for Bitcoin’s Growth

Institutional interest in Bitcoin continues to grow, with major developments shaping the market:

- Spot Bitcoin ETFs (approved in early 2024) have brought billions in institutional capital.

- Corporate treasuries (like MicroStrategy and Tesla) keep adding BTC to their balance sheets.

- Regulatory clarity in the U.S. and Europe is encouraging more hedge funds and banks to enter the crypto space.

As institutional demand rises, Bitcoin’s scarcity (only 21 million BTC will ever exist) could fuel a supply shock, driving prices higher.

Bitcoin vs. Gold: The Ultimate Store of Value Debate

Bitcoin is increasingly seen as “digital gold,” with several advantages:

✔ Scarcity: Fixed supply vs. gold’s uncertain mining reserves.

✔ Portability: Easy to transfer globally compared to physical gold.

✔ Transparency: Blockchain verifiability vs. gold’s storage risks.

However, gold still holds a $14T+ market cap, while Bitcoin remains under $1T. If BTC captures even 10% of gold’s market share, its price could exceed $500,000 per coin.

Final Thoughts: Is Bitcoin a Must-Hold in 2025?

With the halving-induced supply shock, increasing institutional adoption, and its growing reputation as a store of value, Bitcoin is poised for a potential bull run in 2025. While $150K+ is plausible, much depends on macroeconomic factors like:

- Federal Reserve policies (interest rate cuts could boost BTC).

- Global adoption (more countries recognizing BTC as legal tender).

- Technological advancements (Layer-2 solutions improving scalability).

Should You Buy Bitcoin in 2025?

If you believe in Bitcoin’s long-term value proposition, accumulating during market dips could be a smart strategy. Whether it reaches $150K or higher, BTC remains a high-potential asset in the evolving financial landscape.